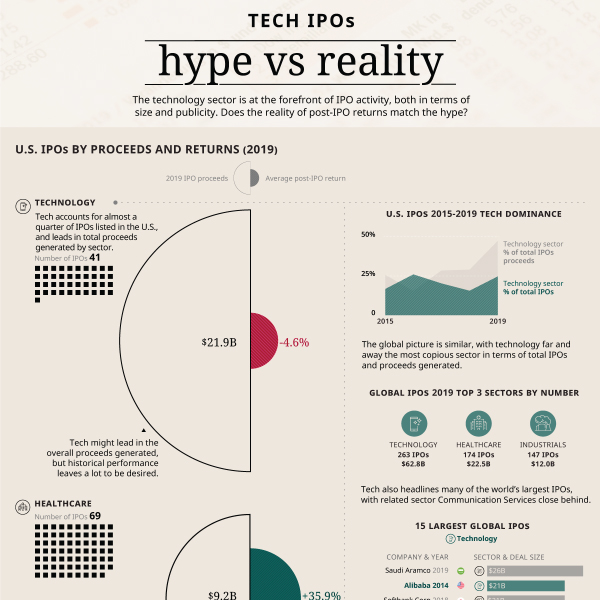

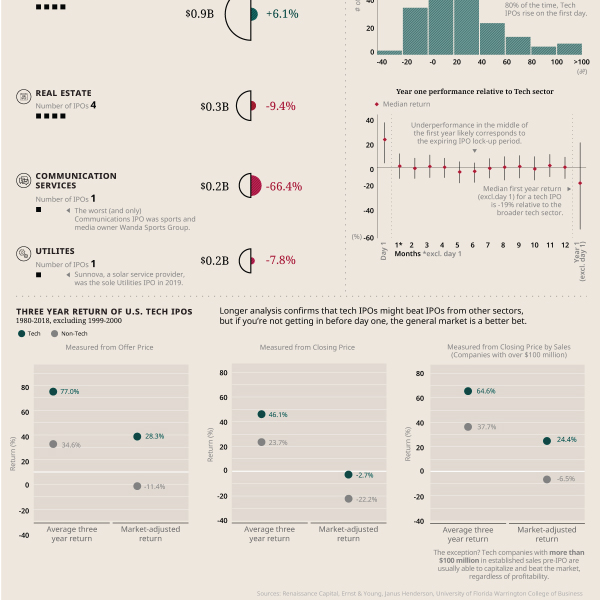

By the Numbers: Are Tech IPOs Worth the Hype?

Initial Public Offerings (IPOs) generate massive amounts of attention from investors and media alike, especially for new and fast-rising companies in the technology sector.

On the surface, the attention is warranted. Some of the most well-known tech companies have built their profile by going public, including Facebook by raising $16 billion in 2012.

But when you peel away the hype and examine investor returns from tech IPOs more closely, the reality can leave a lot to be desired.

First published: August 25, 2020 (link)

Source files included: .ai, .eps, .pdf

Data source: Renaissance Capital, Ernst & Young, Janus Henderson, University of Florida Warrington College of Business

A full license grants you the permission to download and modify our visualization, and to re-publish it in most professional and personal use cases.

Licenses also give you permission to translate our visualizations into another language, provided that you also remove the Visual Capitalist branding.

| Type of License | Full License (1 Credit) |

|---|